The FintechZoom best neobanks are reshaping the financial landscape with digital-first, fee-free banking solutions. Operating without physical branches, these innovative banks offer features like real-time spending insights, multi-currency accounts, and seamless app-based management. Whether you’re a traveler, a tech-savvy individual, or someone looking to save, FintechZoom best neobanks offer flexibility, convenience, and transparency to meet modern financial needs.

What Are Neobanks?

Neobanks, often referred to as challenger banks, are entirely digital financial institutions that have disrupted the traditional banking model. They operate solely online, providing services through mobile apps or web platforms. With an emphasis on low fees, modern features, and convenience, neobanks are tailored to the needs of today’s tech-savvy consumers.

Problem with Traditional Banks

Traditional banks often fail to meet the demands of today’s digital-first world. Long lines, high fees, and limited accessibility force many people to question whether sticking with old systems is worth the hassle. The need for flexible, affordable, and transparent financial solutions has never been more pressing.

Agitate the Pain

Think about the frustration of hidden fees or waiting days for a simple transfer. Add clunky, outdated apps that make managing your money more complicated than it needs to be. For anyone who values their time and finances, traditional banks are increasingly out of touch with modern needs.

Solution: Neobanks

The solution? Neobanks. These digital-first, branchless banks are transforming the way we manage money. They are designed to eliminate unnecessary costs, provide 24/7 accessibility, and offer features tailored to the needs of today’s fast-paced lifestyle. And with FintechZoom best neobanks, you can easily find the perfect match for your banking needs.

Why Choose a Neobank?

Neobanks are quickly becoming the go-to choice for millions due to their lower costs, smarter tools, and 24/7 access. FintechZoom best neobanks offer options that cater to various lifestyles, from savvy savers to global travelers. With FintechZoom best neobanks, you get all the convenience of digital banking with none of the fees or hassles.

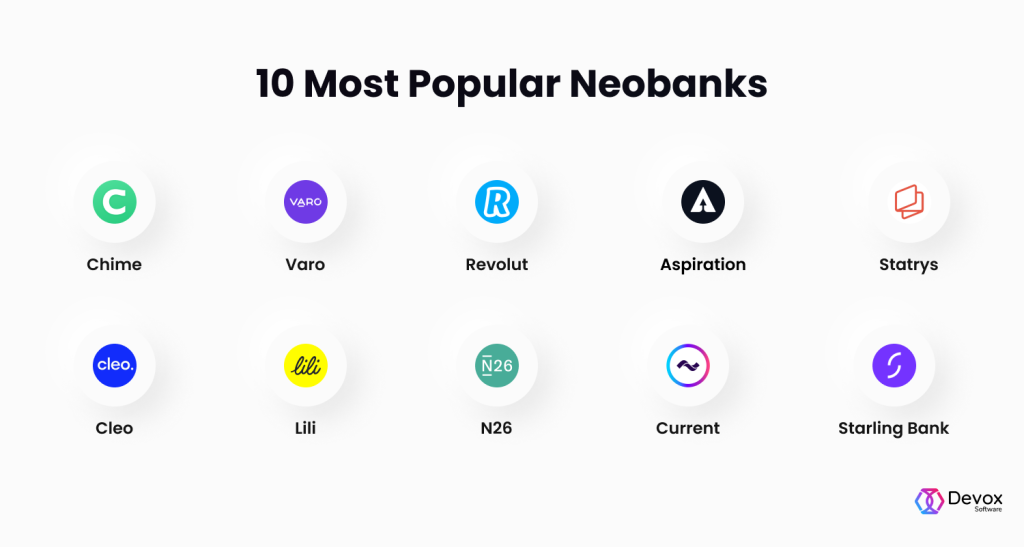

FintechZoom’s 7 Best Neobanks

- Chime

Chime offers a straightforward, no-fee banking experience, making it one of the most popular FintechZoom best neobanks in the U.S. It features early direct deposit, automatic savings, and access to over 24,000 ATMs nationwide. While it’s a great option for simplicity and affordability, it’s limited to U.S. customers and lacks joint accounts. - N26

For international travelers, N26 is a top contender among FintechZoom best neobanks. Offering free international transactions, multi-currency accounts, and real-time spending insights, it’s a great choice for digital nomads. However, N26 isn’t available in every country and doesn’t yet offer credit card options. - Revolut

Revolut stands out for offering a wide range of services, from cryptocurrency trading and stock investments to currency exchange, all within a single app. It’s ideal for tech-savvy users who want an all-in-one financial solution. However, its premium features can be pricey, and customer service is sometimes slow. - Varo Bank

Varo Bank offers a high-yield savings account, no monthly fees, and competitive interest rates, making it perfect for budget-conscious savers. Although Varo excels in savings, it lacks business banking options and the ability to deposit cash at ATMs. - Monzo

Monzo is known for its sleek, user-friendly app that includes budgeting tools and real-time notifications. It’s a great option for frequent travelers due to its lack of foreign transaction fees. However, some premium features require a paid subscription, and it has limited credit products. - Starling Bank

Starling Bank is celebrated for its excellent customer service and flexible accounts for both personal and business use. It offers fee-free international transactions and advanced money management tools, though it’s currently only available in the UK, limiting its global reach. - SoFi

SoFi is a comprehensive financial platform offering services like student loan refinancing, investing, and insurance. As one of the FintechZoom best neobanks, SoFi is a great option for young professionals. It’s not available globally, and cash deposit options are limited.

Key Features of Neobanks

- Low or No Fees

Neobanks often eliminate traditional banking fees such as maintenance, overdraft, and foreign transaction fees. For example, FintechZoom best neobanks like Chime and Varo Bank provide fee-free services that help users save money. - Advanced Mobile Apps

The best neobanks prioritize seamless user experiences with mobile apps that offer real-time spending insights, budgeting tools, and transaction notifications. FintechZoom best neobanks utilize cutting-edge technology to help users manage their finances effortlessly. - Instant Transactions

Many FintechZoom best neobanks offer instant fund transfers and early access to direct deposits, which is especially helpful for freelancers and contractors. - Global Accessibility

Neobanks like Revolut and N26 offer global services, including multi-currency accounts, and help users avoid high international fees, making them great for travelers. - Innovative Financial Services

Some neobanks offer unique features such as cryptocurrency trading, stock investments, and loan options. FintechZoom best neobanks like Revolut and SoFi are known for their innovative financial services.

How Do Neobanks Compare to Traditional Banks?

| Feature | Neobanks | Traditional Banks |

|---|---|---|

| Accessibility | 24/7 via mobile apps | Limited to business hours |

| Fees | Low or zero fees | High maintenance and overdraft fees |

| Services | Tailored digital solutions | Comprehensive but outdated |

| Physical Presence | Fully online | Physical branches available |

| Global Usage | International features common | Limited or expensive overseas options |

Advantages of Neobanks

- Transparency

With clear terms and no hidden fees, neobanks offer complete transparency. - Accessibility

Manage your finances anytime, anywhere with just a smartphone and internet connection. - Customization

Personalized financial tools help users optimize their spending and saving habits. - Environmental Impact

Without physical branches, neobanks have a smaller carbon footprint, making them ideal for eco-conscious users. - Security

Neobanks use state-of-the-art encryption and biometric authentication to protect customer data.

The Future of Neobanks

By 2025, neobanks are expected to continue evolving. FintechZoom best neobanks will integrate advanced AI for more personalized financial recommendations, blockchain for secure transactions, and global partnerships to enhance accessibility. Additionally, they will prioritize even higher security standards to combat cyber threats.

Conclusion

Tired of traditional banking hassles? It’s time to switch to the FintechZoom best neobanks. With seven exceptional options tailored to different needs, these neobanks offer low fees, advanced technology, and a seamless user experience. Make the change today and start enjoying a modern banking experience designed for the digital age.